Profit and Loss

Profit & Loss (P&L) Overview

What is a P&L?

A Profit and Loss (P&L) statement provides a detailed summary of a company's revenues, costs, and expenses over a specific period. It offers a comprehensive view of a business's financial health, allowing you to identify areas for growth and improvement. With your 3fin subscription, you have access to a P&L dashboard that accurately tracks the profitability of your Amazon business.

Why Should You Regularly Check Your P&L?

In recent years, Amazon's fees have risen significantly, making accurate P&L tracking more essential than ever. Regularly monitoring your P&L at the account, brand, or even SKU level helps you maximize profitability across your product range. Given that Amazon now takes more than 50% of sellers' revenue, effective profit management is crucial for thriving in this highly competitive marketplace.

A typical cost structure for an Amazon seller includes:

20-30% Cost of Goods Sold (COGS): This includes product costs, freight costs, and any applicable tariffs.

15% Amazon Commission: A referral fee charged on every sale made on Amazon.

20-35% in Fulfillment by Amazon (FBA) Fees: This includes various fees such as fulfillment, storage, and inbound logistics.

15% in Pay-Per-Click (PPC) Advertising Costs: Expenses incurred to promote products on Amazon’s marketplace.

Which Metrics Are Included in the P&L?

3fin’s retrieves and classifies all the transactional data from your seller central account to provide you with a detailed and accurate P&L for at least the past 24 months.

Here is a breakdown of the main items you can track using 3fin’s P&L:

Units sold and refunded

Average selling price (ASP)

Sales, promotions and net revenue

Cost of Goods Sold (COGS) (*user needs to input COGS)

Amazon fees such as commission, fulfilment, storage, inbound fees etc.

Advertising costs

Other Amazon costs (subscription, amazon vine etc.)

Contribution Margins and Net Profit

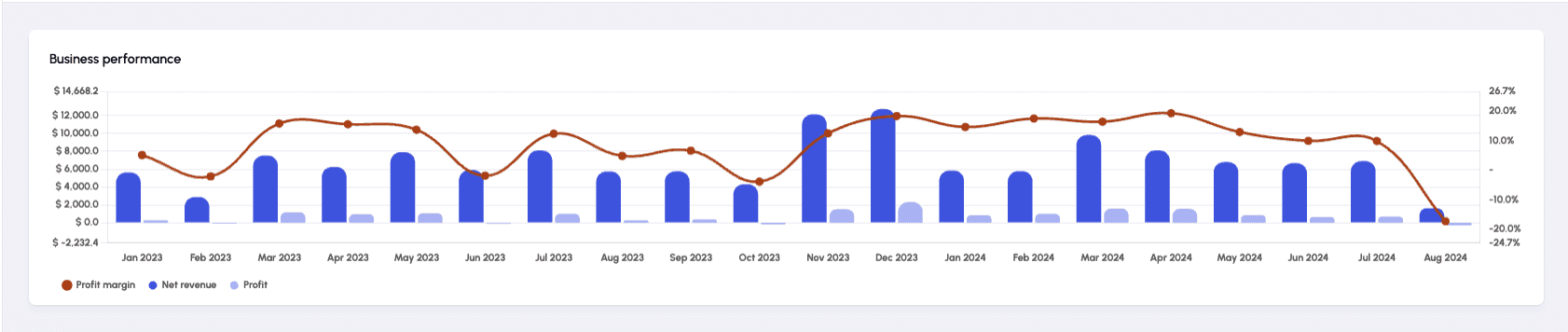

Business Performance Chart

The top section of the P&L dashboard is a business performance chart showing your net revenue, profit, and profit margin of your Amazon business.

The chart dynamically adapts to the date range selected for the dashboard.

P&L Filters

Here is an overview of the filters & options available on the 3fin P&L:

1) Marketplace: let’s you filter the P&L by marketplace. You can quickly (de)select all marketplaces or only select the specific marketplaces for which you want to see your P&L. Note that some costs are charged at an account level and will be shown on the P&L regardless of the marketplace selected.

2) Currency: select in which currency the P&L should be displayed. Note that 3fin uses fixed exchange rates that are updated on a monthly basis (meaning historical data will be converted to the desired currency using the latest monthly exchange rate available)

3) Date Range: filter the P&L to show only the desired date range. 3fin shows at least 24 months of historical data. Note that if the selected date range is less than one month, the P&L will be displayed by day. You can change this with the default interval button by clicking in the arrow in the top right corner

The date selector also features pre-set date ranges to facilitate navigation:

L3M = Last 3 months

L6M = Last 6 months

T90D = Last 90 days

T30D = Last 30 days

T7D = Last 7 days

4) Brands: let’s you filter the P&L by brand. If your seller central account features multiple brands, this filter enables you to see the P&L for each brand.

5) Summary Columns: let’s you easily add summary periods to the P&L. The following summary periods are available for the current year and year before:

YTD = Year-to-date: sums up any amount from the 1st of January until the current day

LTM = Last twelve months: sums up any amount over the last 12 months, with the end date being the last full month.

L3M = Last three months: sums up any amount over the last 3 months, with the end date being the last full month.

6) Oldest to Newest: let’s you select whether you want to display the P&L columns from oldest (left) to newest (right) or from newest (left) to oldest (right)

7) Default Intervals: let’s you select the granularity of the P&L. By default, 3fin will use the best granularity for the date range selected. But you can also choose a month by month or week by week granularity.

8) Product Search Bar: use the search bar to filter the P&L for one or more ASINs. Note that the P&L will only display sales and costs available at a product level ; costs at an account level will not be displayed when filtering by product.

9) Growth: select whether you want to see year over year or month over month growth.

Reading Your 3fin P&L

Units Sold & Average Selling Price (ASP)

The top section of the P&L provides key data points to help you analyze your business performance:

Units Sold: The total number of units sold during the specified period, excluding refunded units.

Units Sold Growth: The percentage growth (or decline) in units sold, year-over-year or month-over-month. You can adjust the comparison period using the button on the top left of the P&L.

Units Refunded: The number of units refunded during the specified period. Note that refunded units may have been originally sold 1 to 3 months earlier.

Net Units: Calculated as Units Sold minus Units Refunded.

Gross ASP (Average Selling Price): Calculated as Sales divided by Units Sold. This represents the gross average selling price of your products, excluding any promotions or refunds.

Net ASP (Average Selling Price): Calculated as (Sales - Promotions) divided by Units Sold. This represents the net average selling price of your products, factoring in the impact of promotions and discounts.

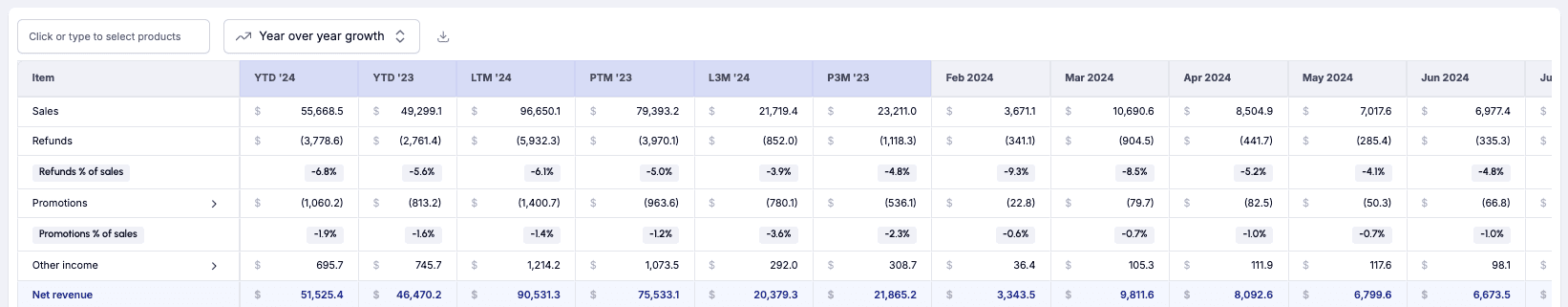

Top Line: From Sales to Net Revenue

Sales: The total value of products sold, recognized on the posted date, net of sales tax/VAT. Canceled orders are not included.

Refunds and Refunds % of Sales: Refunds represent a reversal of recognized revenue for returned units. It’s important to monitor your Refunds % of Sales to ensure it remains as low as possible.

Promotions and Promotions % of Sales: This includes the cost of offering coupons, running lightning deals, and other promotional activities. Note that the Promotions line also includes Amazon fees related to these deals.

Other Income: The total income earned from sources like liquidations, shipping fees, and gift wrap services.

Net Revenue: The total revenue generated by your business after deducting discounts, returns, allowances, and other related expenses.

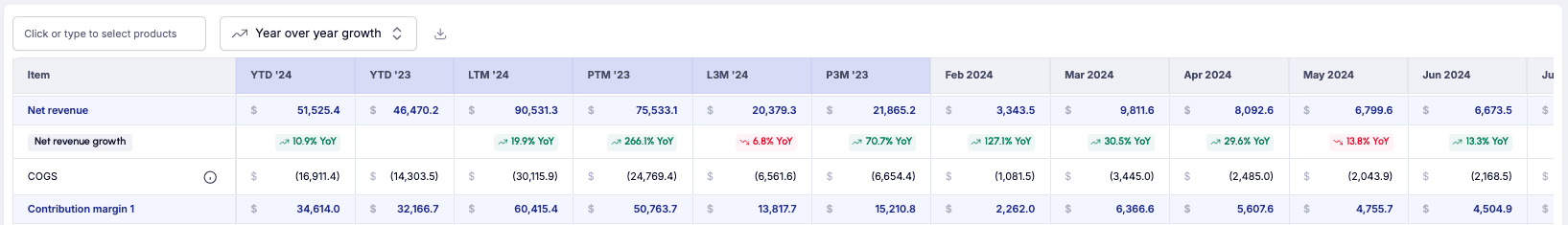

Gross Profit: From Net Revenue to CM1

Cost of Goods Sold (COGS): The total cost incurred to acquire a product and prepare it for sale, including raw materials, labor, shipping, customs duties, taxes, and other expenses related to bringing the product to your warehouse, 3rd Party Logistic (3PL) provider, or Amazon Fulfillment Center.

For a typical Amazon business, COGS represents 20% to 30% of the cost structure, making it a significant factor in your profitability. COGS is one of the few cost items in your P&L that you can directly influence. By negotiating better prices and terms with your suppliers, you can achieve substantial cost savings that directly enhance your profitability.

Contribution Margin 1 (CM1): This metric reflects the impact of pricing, COGS, discounts, refunds, and product mix changes on your profitability. A decline in CM1 or CM1 % can signal various issues that require attention: Is your net revenue decreasing? Are your COGS increasing faster than your sales?

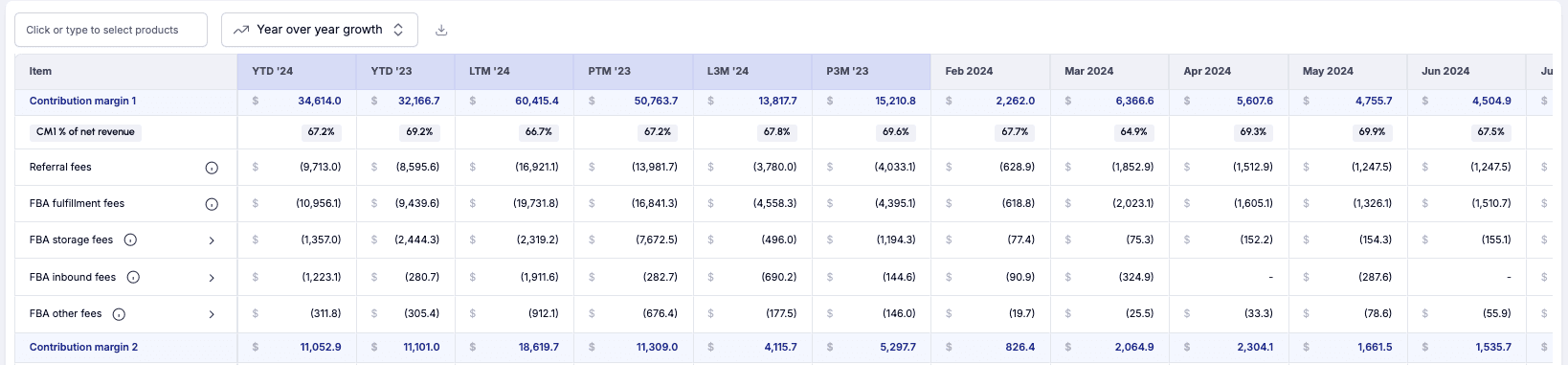

Amazon Cost of Sale: From CM1 to CM2

This section of the P&L includes all costs of sales and fulfillment directly related to Amazon. These costs represent the main fees that Amazon charges for selling and fulfilling your products through their marketplace and logistics system. For a typical Amazon 3P seller, these expenses account for 30% to 40% of the overall cost structure. Although these costs are largely beyond your control, there are a few strategies to reduce them by a few percentage points.

Referral Fees: The commission charged by Amazon for each product sold on its marketplace. For most products, the referral fee is 15%.

FBA Fulfillment Fees: For sellers enrolled in the Amazon FBA Program, Amazon charges a fixed fulfillment fee based on the product’s dimensions and weight.

FBA Storage Fees: Amazon charges monthly storage fees to stock inventory at their fulfillment centers. 3fin provides a breakdown of these fees, including base storage fees, long-term storage fees, and overage storage fees.

FBA Inbound Fees: The costs associated with shipping and processing inventory into Amazon’s fulfillment centers using their partner programs. Since March 1, 2024, Amazon has begun charging U.S. sellers an Inbound Placement Service Fee for shipments that are not “Amazon optimized.” This fee is recorded under “Other Inbound Fees” in the 3fin P&L.

FBA Other Fees: This line includes all other fees related to using Amazon’s FBA services. For most sellers, this should represent a minimal part of the cost structure.

Contribution Margin 2 (CM2): This metric helps you understand how Amazon’s platform fees—such as referral, fulfillment, storage, and other fees—impact your profitability.

To maintain or improve profitability:

Optimize product dimensions to reduce FBA fees.

Adjust pricing to pass on cost increases to consumers.

Monitor inventory levels to avoid excess stock and high storage fees.

Run promotions to sell aged products at break-even.

Advertising: From CM2 to CM3

Cost of advertising: The total “pay-per-click” (PPC) fees charged by Amazon to sellers and vendors for advertising their products on the Amazon platform. Amazon offers several advertising options, including sponsored product ads, sponsored brand ads, sponsored display ads, and sponsored television ads which are all tracked in the P&L.

Contribution Margin 3 (CM3): The CM3 represents the amount of revenue left after paying all costs to acquire, sell, and advertise your product on Amazon. Aim for at least 20% CM3 - of course the higher, the better!

Profitability: From CM3 to Amazon Profit and EBITDA

FBA Inventory Reimbursements: Compensations provided to Amazon sellers for lost, damaged, or incorrectly handled inventory within the FBA program. As those compensations should be exceptional, 3fin classifies them below your CM3.

Other platform fees: these include other amazon fixed or one-time costs such as the Amazon Seller Central subscription fee, Amazon Vine Fees etc.

Amazon profit / (loss): Amazon Profit refers to the amount of money earned after deducting all expenses associated with selling your products on the Amazon platform.

Expenses: Includes all expenses you manually entered in the Expenses dashboard.

EBITDA: Your operating profit after accounting for all amazon and off-amazon expenses.

Growth & Cost Structure

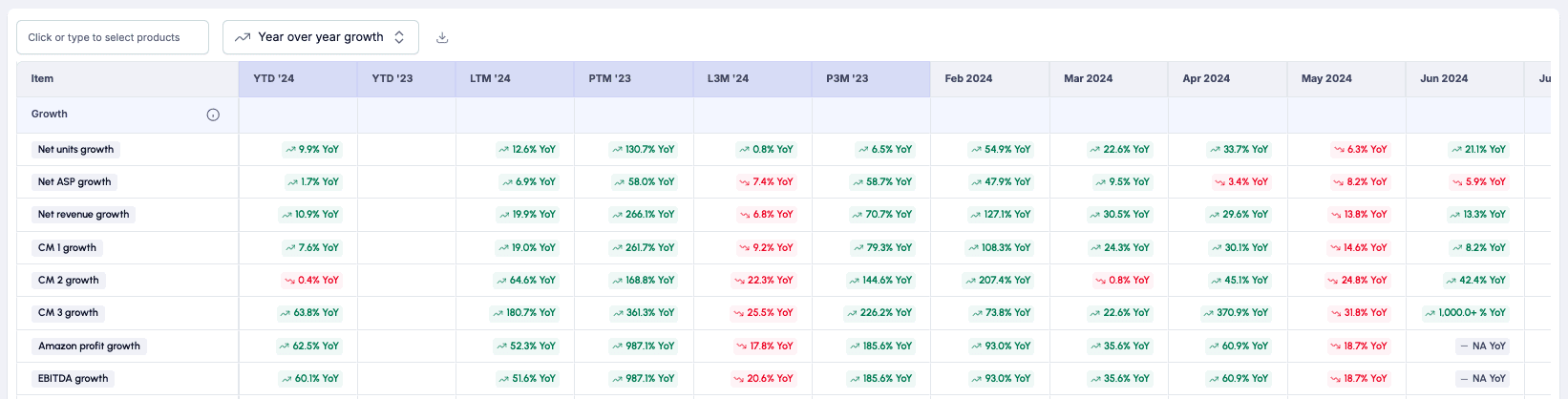

Growth Table

Below the P&L, 3fin displays a dedicated table to show the growth rates of the key metrics from your P&L. Use the button above the P&L to switch from year over year to month over month growth.

The growth table is the easiest way to quickly understand how your business is trending and what the main drivers of profit growth (decline) are. As an Amazon seller, your goal should be to have all growth arrows being green and trending upwards!

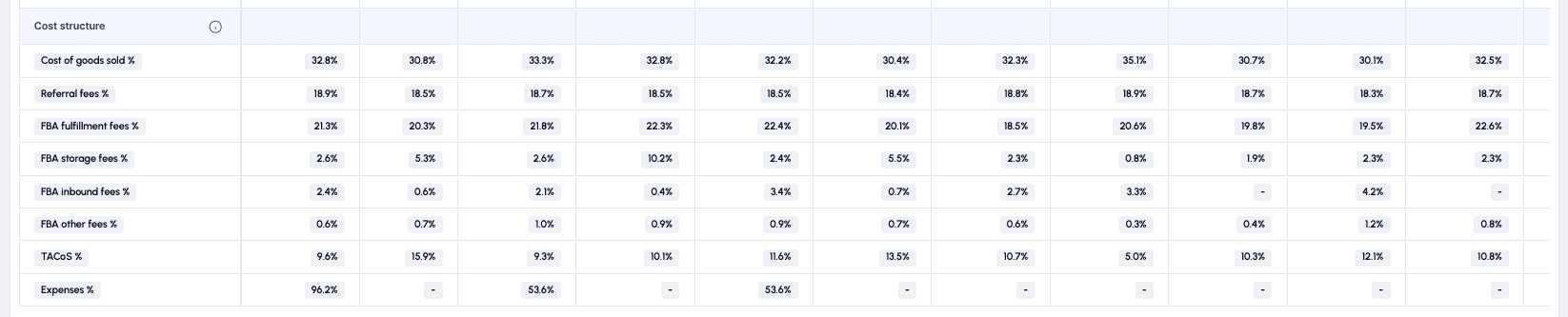

Cost Structure Table

Below the P&L, 3fin displays a dedicated table to show the cost structure of your business. The table displays the main cost items as a percentage of net revenue. The table lets you easily understand what the largest cost drivers are and how they are evolving over time.